Interview

Oxfam: Billionaires increased their wealth by $2 trillion in 2024

Mikhail Maslennikov, policy advisor for Oxfam Italia: ‘We remain a country where the same people are always paying the taxes to support health care and education, now underfunded and at risk of cuts.’

We interviewed Mikhail Maslennikov, policy advisor for Oxfam Italy, on their new report that belies the fallacy of capitalist meritocracy.

Mr. Maslennikov, the wealth of billionaires increased by $2 trillion in 2024. Why do you talk about “unearned wealth” in the report Oxfam released on Jan. 20?

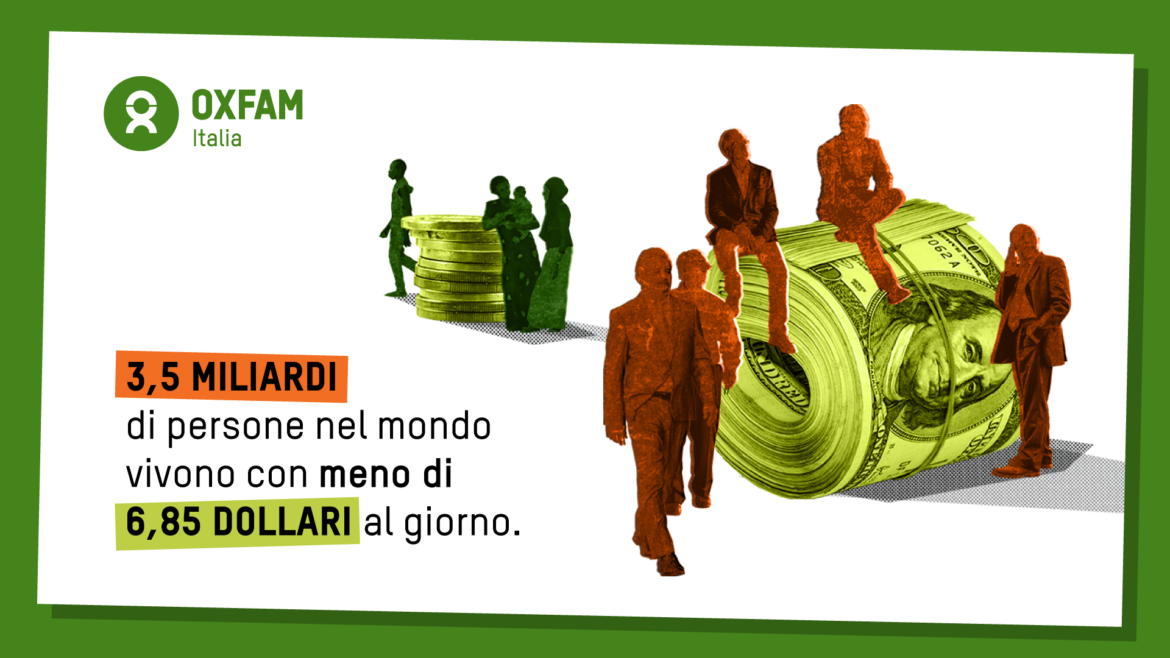

The super-rich like to say that accumulating enormous wealth takes skill, determination and hard work. But are we so sure that extreme wealth is really attributable to individual merit? More than one-third of billionaires' fortunes come from inheritances, and the generational transfer of wealth is likely to grow even more in the next 2-3 decades. It’s hard to argue with those who speak of the advent of a true “global aristocracy.” Extreme wealth is, in part, traceable to systems of patronage relations involving politics and public institutions, and it is most of all intertwined with the immense market power wielded by the corporate giants that billionaires control or direct. This is a monopoly power that guarantees unjustifiable rents.

One can understand why billionaires would seek to ally themselves with Trump, who just took office once again at the White House. But why are the poor also voting for Trump, who will be decimated by his policies?

This is the effect of the economic precarization and cultural marginalization of large segments of the population. They are encouraging adherence to right-wing identitarian political proposals that are taking root from the United States to Europe.

What are the “identitarian politics” you mentioned based on?

On the creation of artificial contrasts among the marginalized. They insist on the concept of a people and nation, seek internal and external enemies, and leverage racism. This type of politics compensates for the failure to achieve economic and social outcomes that benefit the most vulnerable with the fulfilment of identity goals. At the same time, however, they are introducing economic and fiscal policies that benefit those already in privileged positions. They are a very poor substitute for a more inclusive economy and a more equitable society.

In this situation, what are the future prospects for your battle over taxing the rich?

Internationally, there are glimmers of hope: the #TaxTheRich file has become part of the G20 agenda, and it is one of the possible protocols for the United Nations Framework Convention on International Tax Cooperation which will be negotiated starting this year. In Italy, an increase in the tax on large inheritances is out of the question, and the tax on large estates remains taboo, despite enjoying the support of a relative majority even among the center-right electorate.

In the report, you criticize the tax policies of the Meloni government, from cutting the tax wedge to the flat tax. Why?

They don’t respect distributive equity and betray fiscal democracy. The Italian government is disregarding the fact that the very rich pay less in taxes and contributions in proportion to their income than a nurse or a teacher. There is also a trend of increased fracturing of the tax system into multiple preferential regimes, and unfair deals are being made with taxpayers who are not in good standing with the tax authorities. We remain a country where the same people are always paying the taxes to support health care and education, now underfunded and at risk of cuts.

The increase of employment in Italy has been much trumpeted in recent months. Instead, you are skeptical. Why is that?

Because structural weaknesses in the labor market, such as underemployment and low job quality for young people and women, wage gaps and pockets of working poor are not being addressed directly. There is no clear industrial policy geared toward creating good jobs. Collective bargaining has not been strengthened and the minimum wage has been shelved. On the other hand, fixed-term contracts have been liberalized and labor protections in subcontracting have been downsized, with the risk of increasing the proportion of casual and precarious work.

Under Meloni, poverty has increased and is back at an all-time high. How so?

With the “reform” of the citizenship income, the government has effectively abolished the right of every citizen in need to have continuous access to a public subsidy that allows them to lead a decent existence – the only government in Europe to do so. The new “inclusion allowance” has led to a 37.6 percent decrease in the number of beneficiary families, a reduction in the average monthly amount disbursed to large families, and a larger gap between families receiving the allowance and those in absolute poverty, with the exception of families with minor children.

Originally published at https://ilmanifesto.it/maslennikov-oxfam-unaristocrazia-globale-guadagna-2-mila-miliardi-in-piu-in-un-anno on 2025-01-21